Dental insurance is vital for overall health, highlighting the importance of prevention over cure. It enables regular checkups that can help dentists catch and treat issues such as cavities and gum disease early while offsetting the potentially steep costs of dental treatments. Making sense of dental insurance, from its coverage to its limitations, ensures you can make well-informed decisions and receive the best dental care.

What Dental Insurance Typically Covers

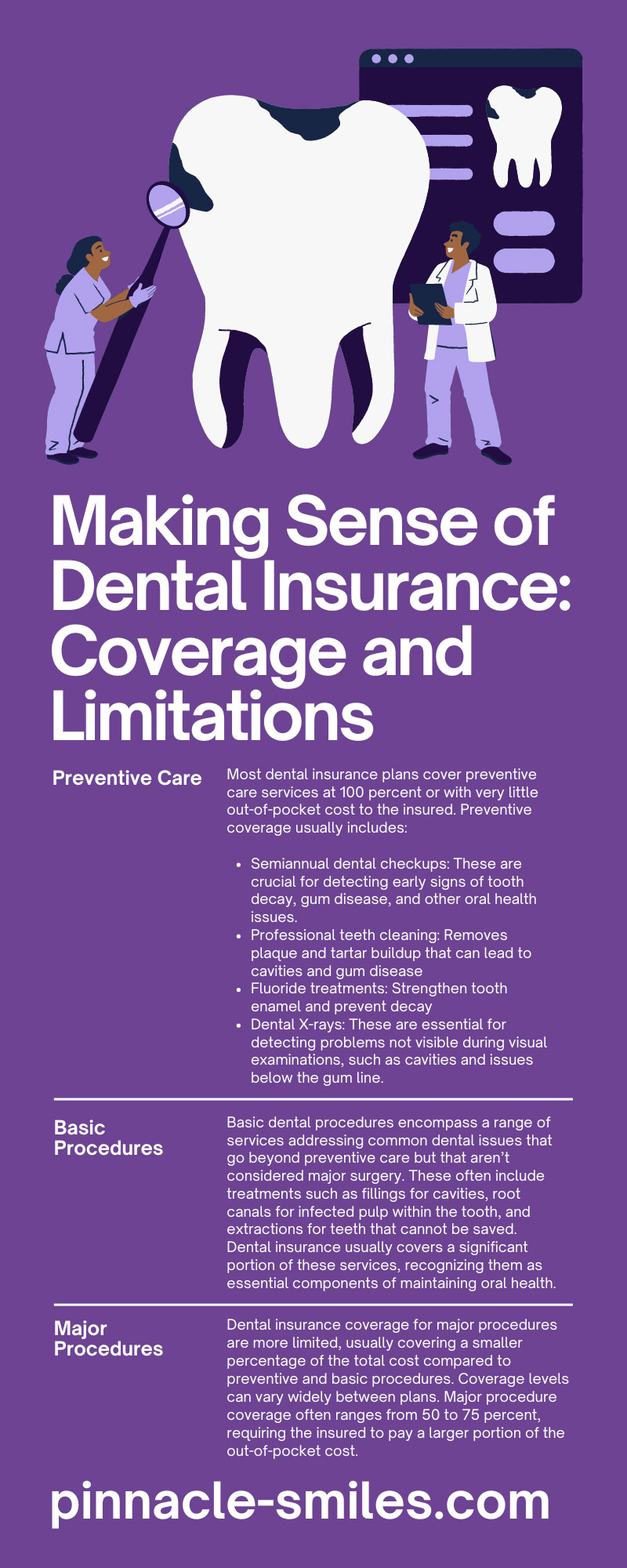

Generally, dental insurance plans categorize services into three main groups: preventive, basic procedures, and major procedures. Specific coverages within each group can vary between different insurance providers and plans.

Preventive Care

Preventive care focuses on maintaining good oral hygiene and preventing the onset of dental issues before they develop into more serious conditions. This concept is grounded in the idea that preventing problems is more efficient and cost-effective than treating them after they arise. Dental insurance plans typically emphasize preventive care, reflecting its critical role in maintaining oral health.

Most dental insurance plans cover preventive care services at 100 percent or with very little out-of-pocket cost to the insured. Preventive coverage usually includes:

- Semiannual dental checkups: These are crucial for detecting early signs of tooth decay, gum disease, and other oral health issues.

- Professional teeth cleaning: Removes plaque and tartar buildup that can lead to cavities and gum disease

- Fluoride treatments: Strengthen tooth enamel and prevent decay

- Dental X-rays: These are essential for detecting problems not visible during visual examinations, such as cavities and issues below the gum line.

By fully leveraging preventive care, you can maintain better oral health, reduce invasive and expensive treatments in the future, and save money on dental care costs.

Basic Procedures

Basic dental procedures encompass a range of services addressing common dental issues that go beyond preventive care but that aren’t considered major surgery. These often include treatments such as fillings for cavities, root canals for infected pulp within the tooth, and extractions for teeth that cannot be saved. Dental insurance usually covers a significant portion of these services, recognizing them as essential components of maintaining oral health.

The coverage level for basic procedures typically falls between preventive care and major procedures. Patients may not receive 100 percent coverage as they often do for preventive visits, but dental insurance still offsets a substantial percentage of the cost. Copayments and deductibles may apply.

Major Procedures

Major procedures refer to more complex and expensive treatments. These may include services such as crowns, bridges, dentures, and certain types of oral surgery, all of which are often necessary to address significant dental health issues or restorative work.

Dental insurance coverage for major procedures are more limited, usually covering a smaller percentage of the total cost compared to preventive and basic procedures. Coverage levels can vary widely between plans. Major procedure coverage often ranges from 50 to 75 percent, requiring the insured to pay a larger portion of the out-of-pocket cost.

Network Coverage

Network coverage refers to the group of dental care providers and facilities that have an agreement with the insurance company to provide services to plan members at predetermined rates. You typically have three types of networks to choose from:

HMO (Health Maintenance Organization)

In an HMO plan, you choose a primary care dentist (PCD) from within the network who coordinates all of your dental care. Visits to specialists require a referral from your PCD. These plans usually have lower premiums and no deductibles, but they offer less flexibility in choosing providers.

PPO (Preferred Provider Organization)

PPO plans provide more flexibility, allowing members to see dentists inside or outside their networks. Seeing an in-network dentist usually means lower out-of-pocket costs. PPO plans often come with higher premiums and deductibles, but many people prefer them for their flexibility and wider choice of dentists.

Indemnity Plans

These plans offer the greatest freedom, allowing you to visit any dentist you wish. The insurance company reimburses a portion of the total charges directly to you or the dentist. These plans provide the most flexibility, but they often come with higher cost-sharing and premiums.

Limitations and Exclusions

Dental insurance provides valuable coverage and reduces out-of-pocket expenses, but understanding the limitations and exclusions of most plans is crucial. Limitations often include annual maximums, which cap the amount an insurance company will pay within a given year. Once you reach this limit, you are responsible for all additional costs.

Exclusions are particular services or conditions that a plan does not cover. Common exclusions encompass cosmetic procedures and orthodontic treatments, including braces, which might be only partially covered or not covered at all. Some plans may also exclude preexisting conditions or impose waiting periods before certain benefits become available.

Co-payments and Deductibles

The concepts of co-payments and deductibles are fundamental to most dental insurance plans, and they directly affect your out-of-pocket expenses. A deductible is the amount you must pay each year before your insurance starts to cover its share of the costs. When you meet your deductible, you are responsible for a co-payment, which is a fixed amount that you pay for each service or visit.

For example, after you meet a $50 annual deductible, a $20 co-payment may apply for each following covered visit to the dentist. Co-payments and deductibles are designed to share the cost of care between you and your insurance provider, encouraging judicious use of dental services.

Choosing the Right Plan

Choosing the right dental insurance plan requires careful consideration of your specific needs, your budget, and the types of dental services you anticipate requiring. Start by evaluating the frequency of your dental visits and the level of care you typically need—are preventive services sufficient, or do you foresee the necessity for basic or major procedures? Analyze the differences in premiums, deductibles, and co-payments across various plans, and consider how these costs align with your financial situation.

Pro tip: Review the list of in-network providers to ensure that your preferred dentist is covered or that suitable alternatives are available in your area.

Traditional Insurance Alternatives

In addition to traditional dental insurance plans, consider in-house dental plans from dental practices. These plans often involve a yearly membership fee that covers a certain number of preventive visits and offers discounts on other services. They’re not insurance in the traditional sense, but in-house plans can be affordable alternatives, especially for individuals seeking simpler, more direct relationships with their dental care providers.

If you’re looking for dental care in Albany, Pinnacle Dental Associates offers two in-house insurance plans. Our Key Smile memberships provide affordable, valuable dental coverage for families on budgets, for people who need immediate treatment, and for retirees on fixed incomes.

By making sense of dental insurance, from coverages to limitations, you can enhance your dental care and experiences. When you’re able to make informed decisions, you can choose a plan that effectively supports your dental-health goals, ensuring smiles all around.